Managing retirement plans is a significant responsibility for businesses, requiring strict compliance with regulations to avoid penalties and ensure fiduciary standards are met. Outsourcing 316 Fiduciary services can provide companies with expert oversight while potentially reducing costs. In this analysis, we’ll explore the financial benefits of outsourcing these services, calculating ROI, and discovering unique cost-saving opportunities that come with bringing in a trusted partner like Admin316.

Understanding the Financial Benefits of Outsourcing 316 Fiduciary Services

What Are the Financial Benefits of Outsourcing 316 Fiduciary Services?

- Reduced Administrative Burden

Outsourcing fiduciary duties shifts administrative responsibilities away from in-house teams, freeing up internal resources. By leveraging external fiduciary expertise, businesses can streamline operations, allowing HR or finance teams to focus on other essential tasks without being bogged down by the intricate details of retirement plan compliance. - Avoidance of Penalties

Compliance errors, such as late filings or inaccurate contributions, can lead to costly penalties. A 316 Fiduciary ensures that all filings, deadlines, and regulatory obligations are handled accurately, significantly lowering the risk of penalties. In this way, businesses can benefit financially by avoiding fines that may result from administrative oversights. - Economies of Scale

316 Fiduciary providers like Admin316 serve multiple clients, allowing them to optimize processes and maintain high standards of compliance efficiently. This scale enables fiduciary providers to offer their services at a lower cost than managing the fiduciary duties in-house, where training and staying updated on regulations could incur higher expenses.

Data Table: In-House vs. Outsourced Fiduciary Costs

| Cost Factor | In-House | Outsourced |

|---|---|---|

| Administrative Tasks | High | Lower |

| Compliance Penalties | Variable | Reduced |

| Training & Development | Ongoing | Minimal |

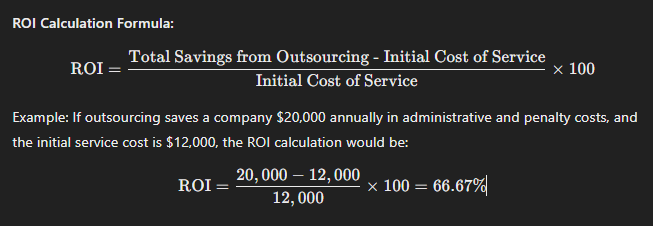

Calculating the ROI of 316 Fiduciary Services

How Can Businesses Calculate the ROI of 316 Fiduciary Services?

- Direct Cost Savings

Outsourcing fiduciary services eliminates the need for ongoing training, reduces the hours spent on compliance tasks, and minimizes penalties. These savings are direct and measurable, making it easy to see the financial benefits over time. - Improved Efficiency and Reduced Errors

By reducing compliance errors, 316 Fiduciary services prevent the costs associated with error correction. Moreover, with experts handling these duties, administrative efficiency is greatly improved, allowing for smoother, uninterrupted plan management. - Long-Term Compliance and Reputation

Consistently meeting fiduciary standards not only reduces direct costs but also enhances the business’s reputation. Employees trust in a well-managed retirement plan, and business partners are more likely to engage with compliant organizations, boosting overall credibility and contributing to long-term ROI.

Unique Cost-Saving Opportunities in 316 Fiduciary Services

Are There Cost-Saving Opportunities Unique to 316 Fiduciary Services?

- Expertise in Regulatory Compliance

316 Fiduciaries stay updated on the latest regulatory requirements, helping companies remain compliant without the need for costly legal advice. This expertise reduces the risk of legal exposure due to missed or misunderstood compliance mandates. - Access to Fiduciary Technology and Tools

Trusted 316 Fiduciary providers, like Admin316, utilize advanced technology that automates many compliance processes, leading to a reduction in administrative time and cost. Automation helps in managing complex documentation and filings with accuracy, allowing for smoother, more cost-effective management. - Customizable Service Plans

With a 316 Fiduciary, businesses can tailor services to their specific needs. This customization allows companies to choose only essential services, optimizing costs by selecting fiduciary services that align with their unique requirements rather than adopting a one-size-fits-all approach.

Data Table: Cost-Saving Opportunities with 316 Fiduciary Services

| Cost-Saving Opportunity | Description |

|---|---|

| Reduced Compliance Errors | Avoids costly penalties and fines |

| Lower Legal Consultation Needs | Managed regulatory compliance |

| Access to Compliance Technology | Automates processes, reducing admin time |

FAQs

What are the financial benefits of outsourcing 316 Fiduciary services?

Outsourcing helps reduce administrative costs, minimizes penalties, and streamlines fiduciary responsibilities, offering substantial financial benefits compared to in-house management.

How can businesses calculate the ROI of 316 Fiduciary services?

ROI is calculated by assessing direct cost savings, improved compliance efficiency, and reduction of errors against the initial cost of service. These savings often result in a positive ROI due to reduced compliance costs and administrative expenses.

Are there cost-saving opportunities unique to 316 Fiduciary services?

Yes, cost-saving opportunities include reduced compliance errors, lower legal expenses, and access to advanced compliance technology that improves process efficiency.

Outsourcing 316 Fiduciary services can make a significant difference in both cost savings and compliance assurance. By alleviating the administrative burden, reducing error-related penalties, and providing access to specialized fiduciary expertise, companies can enjoy substantial financial benefits. For businesses looking to streamline fiduciary responsibilities, a trusted provider like Admin316 can deliver customized solutions that maximize efficiency and compliance.

If your business is ready to explore the cost advantages of 316 Fiduciary services, connect with Admin316 for a personalized consultation and discover how our fiduciary expertise can benefit your company.