401K Retirement Plan Administrator & Fiduciary services

We help you navigate complex regulatory requirements with ease, ensuring your organization’s retirement plans are compliant and well-managed.

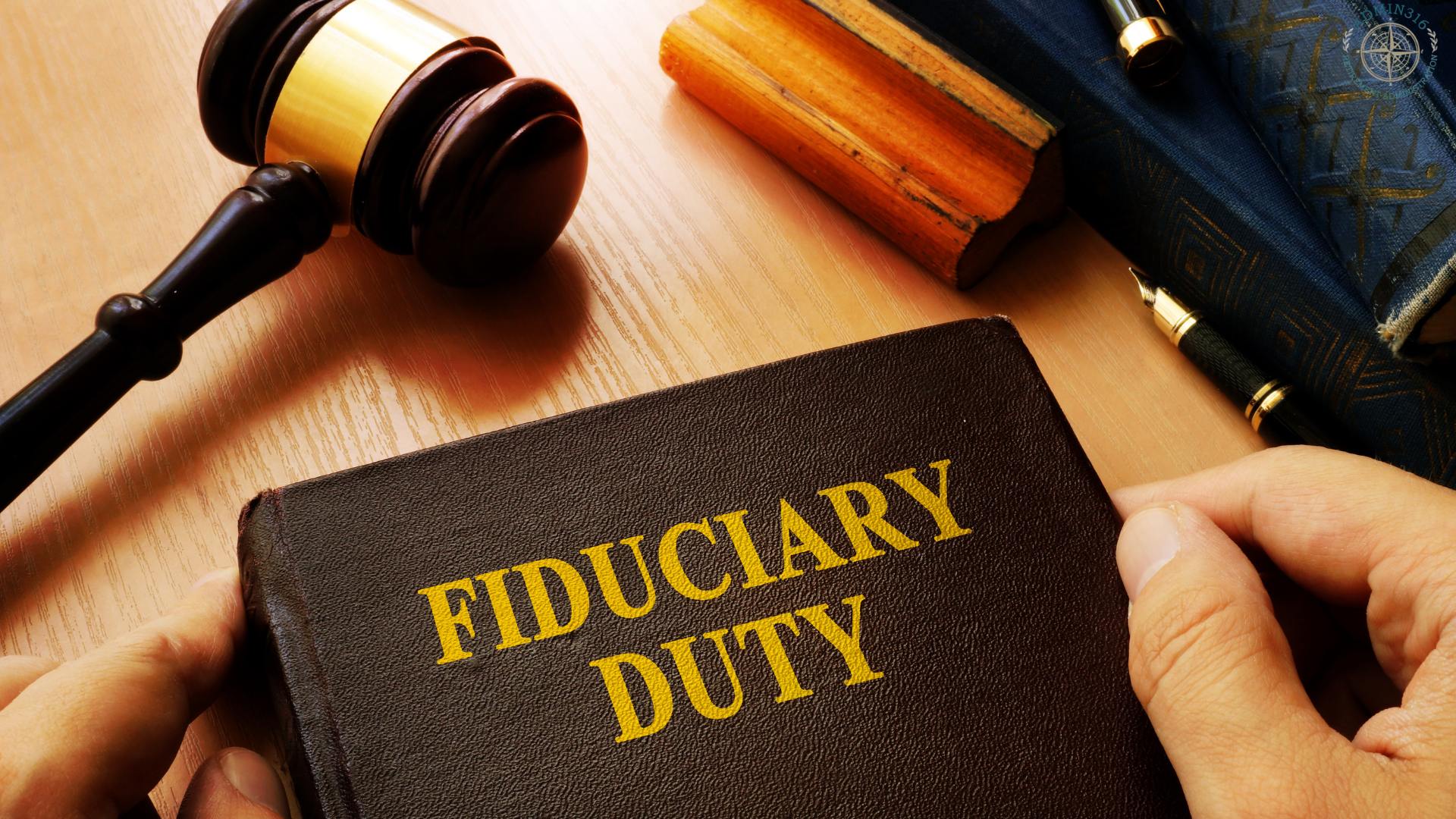

Fiduciary Management

We offer expert guidance to meet regulatory requirements while safeguarding your organization’s fiduciary responsibilities.

316 Fiduciary

Our 316 Fiduciary services take the burden of administrative responsibilities off your shoulders, ensuring full compliance with ERISA requirements.

By acting as your 316 fiduciary, we manage day-to-day plan operations, allowing you to focus on your business while we handle the complexities of retirement plan administration.

338 Investment Fiduciary

Our 338 Investment Fiduciary services offer expert management and decision-making authority over your retirement plan’s investments. By taking on the responsibility for selecting and monitoring investment options, we help ensure your plan’s assets are optimized while maintaining strict fiduciary compliance.

403a(1) Direct Trustee

Our 403(a)(1) Direct Trustee services provide comprehensive oversight of your retirement plan’s assets, ensuring they are held and managed in compliance with regulatory standards. With our expert guidance, you can trust that your plan’s funds are safeguarded, allowing you to focus on your organization’s long-term goals with peace of mind.

How We Work

Ensuring compliance with retirement plan regulations is indeed a fundamental pillar of effectively managing your retirement program.

To streamline this complex process, outsource these services to us.

We create innovative solutions with a comprehensive approach to automating crucial tasks such as the preparation of government forms, the generation of necessary documents, and efficient data collection.

By leveraging this technology, you can stay up-to-date with the ever-evolving regulatory landscape, thereby significantly reducing the administrative burden on your team. This not only lightens the resource load but also mitigates the potential liability risks that can arise from non-compliance.

Ultimately, adopting these tools can empower you to maintain your retirement plan with confidence, ensuring that it adheres to the highest standards of prudence and professionalism

OUR MISSION

Our Philosophy

Admin316 stands out as a leading independent fiduciary for a variety of employer-sponsored retirement plans, including popular options such as 401(k), 457, 403(b), ESOPs, and defined benefit plans.

We empower plan sponsors by offering the unique opportunity to appoint a seasoned, external expert to take on the role of a full-scope 3(16) fiduciary.

Our Guarantee

With a reputation for excellence, Admin316 is recognized as one of the most comprehensive pension administrator companies available, committed to providing exceptional service and ensuring the highest standards of compliance and accountability in retirement plan management.

Our Promise

We work collaboratively with your current service providers and do not require changes to your preferred relationships. Retain your:

Payroll service, advisors, ERISA counsel, Non-fiduciary third party administrator (TPA), custodian, recordkeeper and / or investment manager, and CPA auditor. You do not have to change anything and we can take on the administrative responsibility, handle the day-to-day management of the plan, and reduce the overall cost between 32% – 65%.

OUR PARTNERS

FREQUENTLY ASKED QUESTIONS

How can a retirement plan administrator help reduce liability for plan sponsors?

A retirement plan administrator, especially a 316 fiduciary, manages administrative tasks such as compliance with ERISA regulations, ensuring the timely filing of government forms, and overseeing day-to-day operations. By delegating these duties, plan sponsors can reduce their exposure to potential fiduciary liability while maintaining focus on their core business operations.

What is the role of a fiduciary financial planner in retirement plan management?

A fiduciary financial planner plays a key role in ensuring that retirement plans are managed in the best interest of participants. By providing fiduciary wealth management services, they offer strategic financial advice, oversee investment options, and ensure compliance with regulations, helping plan sponsors fulfill their fiduciary responsibilities while optimizing the plan’s performance.

What is the benefit of using a 316 fiduciary for retirement plan administration?

A 316 fiduciary takes on the full administrative responsibilities of a retirement plan, including compliance, participant notifications, and filings. This alleviates the burden on company executives and HR teams, allowing them to delegate these complex duties to a fiduciary management expert who ensures the plan remains compliant and cost-effective.

How does fiduciary wealth management differ from traditional retirement plan administration?

Fiduciary wealth management involves not only managing the day-to-day administrative tasks of a retirement plan but also providing strategic financial oversight to ensure that the plan’s investments are aligned with the best interests of its participants. Certified financial planner fiduciaries go beyond compliance, offering long-term financial strategies to optimize plan performance.

OUR BLOGS

Common Misconceptions About 316 Fiduciary Services

When it comes to managing employee retirement plans, many business owners, especially those in mid-sized companies, encounter confusion and misconceptions about 316 Fiduciary services. Unfortunately, these misunderstandings can lead to delayed adoption of these...

Reviewing 401k Plans for Roth vs. Traditional Contribution Options

When it comes to retirement planning, one of the most important decisions you'll make is how to contribute to your 401k. The choice between Roth and Traditional 401k contributions can have a significant impact on your retirement savings, tax strategy, and long-term...

Key Responsibilities of a 403a(1) Direct Trustee

A 403a(1) Direct Trustee plays a critical role in overseeing and managing the administration of retirement plans. As a fiduciary, a trustee is entrusted with the responsibility of acting in the best interests of plan participants. Understanding the specific duties of...

Phone

Admin316 Retirement Administration

Admin316 has been in service in the retirement plan space since 97.